The My.N Commodity Trading module provides a single screen for managing the three core areas of a trade - purchasing, logistics and sales.

This allows Traders to accurately model the profitability of a trade prior to a purchase or sales commitment being made, finance can manage funding and logistics can manage the administrative process. All this from a single screen and data set.

Trading

- Pre-deal Analysis

- Real-time Trade Capture

- Back Office Financials

- Risk Management and 'What if' Testing

- Currency Hedges

- Batch traceability from source to destination

- Document Workflow Management

- Compliance, Regulation and Certificates of Conformity

- Powerful query and reporting tools

- Promotes proactive decision making

- Streamlined processes

For Purchasing, the Trading screen allows acquisition costs to be combined with purchase costs to provide a true cost of purchase. This includes transport costs such as shipping, insurance, duties and levies, and administrative costs including Letters of Credit, Import Licences, currency Hedges and funding costs.

Once you know what a shipment is going to cost you to land, the details of the sale can be entered. The data from these two trading functions are then brought together, providing a summary of the costs, profits and margin. Any changes in purchasing costs or the selling price immediately reflect in the summary.

For Logistics, documentation workflow is managed making sure that paperwork is provided in the right order, to the right people, at the right time.

My.N also organizes and stores all incoming and outgoing emails, contacts and documents against a Trade in order to improve the business communication workflow.

My.N's Commodity Trading module helps companies precisely measure and manage market risk, evaluate performance and ensure regulatory and accounting compliance.

Key Elements of Trading System

Once the prospective sales details are entered, the system calculates the projected margins for the trade. This can all be done prior to the trader being given authorization to give a commitment to the buyer or seller. Once the Trade has been Authorized, purchase and sales contracts are generated out of the trade and this automatically creates the purchase and sales orders.

The whole process is managed as part of a multi-currency accounting engine which maintains the transactions through a full system of currency provisions and GRNI accruals.

The stock system maintains full batch traceability from source to destination with additional functionality available to support manufacturing, product testing and certificate of conformity requirements.

The Trading Screen in Detail

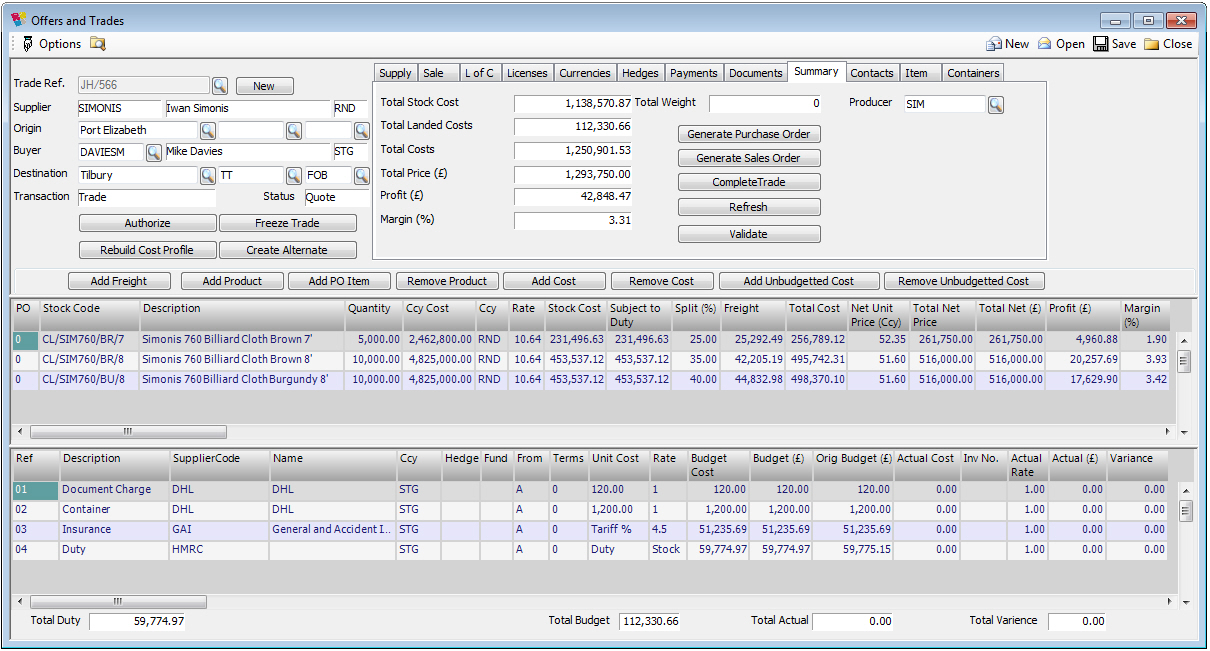

In the example above, the trade relates to three products that are bought in South African Rand at a rate of 10.64 to the pound. The Total Budget for acquisition costs is £112,330.66. This is split between the products in the proportions 25:35:40. The projected selling price entered for each item therefore means the margin per line is projected as 1.9%, 3.93% and 3.42%.

The Summary screen at the top of the form consolidates all of these figures to give you a snap-shot which shows the trade overall will return 3.31%.